July 23, 2025

“Ohio’s interests drove my work and support for this bill from start to finish, and it’s clear that it will lead to more jobs, lower taxes, higher wages and more freedom and prosperity for Ohioans.”

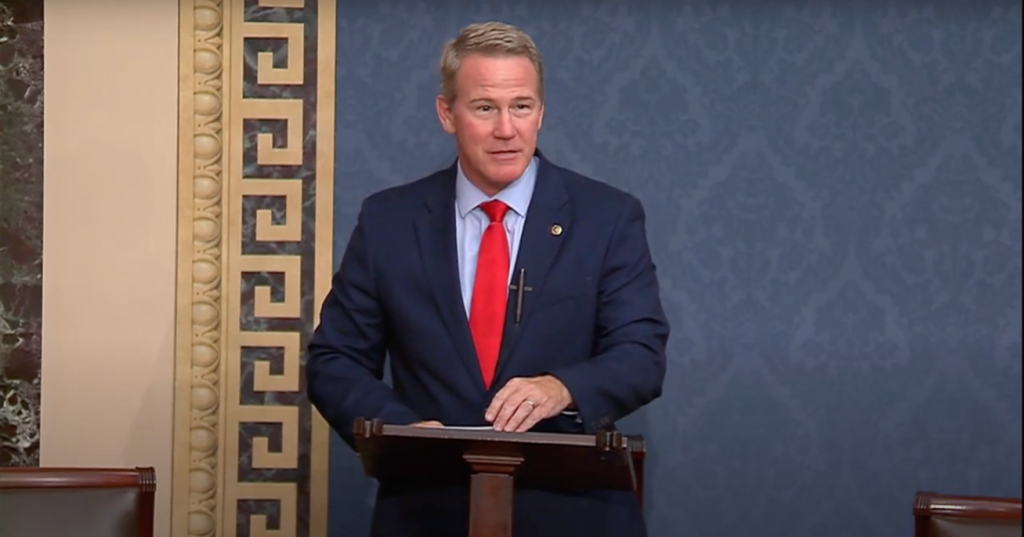

View Husted’s remarks here

WASHINGTON – Sen. Jon Husted (R-Ohio) today delivered a speech on the Senate floor highlighting how the recent budget law is uniquely tailored to support Ohio workers and families.

Key excepts include:

“I want to share with you and the people of Ohio about why I believe it’s a good bill and why I supported it. Because the One Big Beautiful Bill Act, as it’s known, was uniquely tailored to support Ohio workers and families.”

. . .

“The BBB results in more take-home pay for Ohioans, more money in their pockets. More take-home pay means independence. Government dependency means less independence. And that’s why this bill focuses on really allowing workers to keep more of the money they earn.”

. . .

“The tax cuts were cemented for workers and job creators and will leave the average Ohio household with an estimated $7,000 more in take-home pay.

“More specifically, the Council of Economic Advisers estimates the bill will increase take-home pay for the average family with two kids in Ohio from between $6,900 a family to up to $11,700 per family.”

. . .

“And we made no tax on tips and no taxes on overtime a reality. Ohioans work hard. And that’s a change that they can feel legitimately in their pockets.”

. . .

“I was on a telephone town hall last night. One of the ladies who called in said, ‘Hey, I want you to know my husband, he’s a line worker. He works a lot of overtime for the utility company—and that eliminating tax on overtime pay will mean a lot to our family.’

“It’s another aspect to the bill: It’s very important for working people.”

. . .

“We increased the child tax credit up to $2,200 per child. If we’d failed to do this, it would have dropped down to $1,000. It’s now up to $2,200 per child, and that benefit alone will serve 1.3 million Ohio families.”

. . .

“I’m going to brag about Ohio for a minute, if you would allow me, Mr. President, because recently we were named the fifth-best state in the country to do business.

“And it’s gone a long way—from 39th-worst state to the fifth-best in the nation. I was very proud to take part in that when I was lieutenant governor and Speaker of the House.

“What did we do in the bill? A 20% small business tax deduction. It all adds up.

“And it’s estimated that the One Big Beautiful Bill alone is projected to create 1.2 million new U.S. jobs a year over the next decade.”

. . .

“I always say this about Ohio: You can’t do Made-in-America without Made-in-Ohio because we are literally part of the American supply chain. So, what’s good for manufacturing is good for the state of Ohio.

“To that end, we made sure that this legislation gave job creators the freedom to immediately expense investments in new factories, capital investments in machinery and equipment and research and development.”

. . .

“For decades of my life, I have been working on issues surrounding workforce development. How do we help people get the skills they need to compete for the jobs of today and tomorrow?

“Well, in this bill, we allow for Pell Grants to be used for workforce credentials to land good jobs.”

. . .

“It also will help families, from an educational point, at the K–12 level.

“This creates a school choice tax credit that will help create more scholarship opportunities for parents and children to attend a school of their choice.

“Because, frankly, there’s not a decision that you make as a parent or guardian about the future of your child—frankly—that may be more important than the school that they attend.”

. . .

“And then, finally, something that’s very near and dear to me—the Big Beautiful Bill supports Ohio families and vulnerable children by making the adoption tax credit partially refundable up to $5,000.

“As an adoptee—somebody who started my life in a foster home—it’s important to me that, for a child who’s looking for the support of a forever family, we made it just a little bit easier for them to find that family, to support that family.”

. . .

“There are some whoppers of a lie being told about Medicaid right now. And, frankly, it’s bothersome, because I believe, in many cases, these lies are being used to scare some of the most vulnerable people in our society: pregnant mothers, children living in poverty, people with disabilities, the elderly.

“This bill supports strengthening Medicaid to make sure those services are there for you—the people that the program was originally designed to serve.

“I want you to know that Ohioans will have access to more health care resources because of the Big Beautiful Bill than ever before.”

. . .

“This package is sending more Medicaid dollars and more support to rural hospitals in Ohio than ever before.”

. . .

“The state government—the governor and the legislature—raised the provider tax, which they were allowed to do under this bill. And, in doing so, they are going to be able to draw down 60% more Medicaid funding as a result of that provision.

“What does that mean practically for Ohio hospitals? It means—for most hospitals in Ohio—they will receive 24% more reimbursement than they did the previous year. As a result, Ohio will be taking in more Medicaid money than ever to serve those populations.”

. . .

“We’re also safeguarding our future by making sure we are lowering our deficit.”

. . .

“When it was all said and done, and the Congressional Budget Office reviewed the law, the final assessment actually reduces the deficit by $366 billion.”

. . .

“To help pay for our current debt and the benefits we protect, we need laws. We need legislators. We need leaders who are going to make sure that this is top of mind. And I have been and intend to be someone who thinks about those issues.

“I don’t want to leave by saying that this is good enough. There is more work to do to preserve the future for our children and grandchildren by acting in a fiscally responsible way.”

. . .

“Ohio’s interests drove my work and support for this bill from start to finish, and it’s clear that it will lead to more jobs, lower taxes, higher wages and more freedom and prosperity for Ohioans.”